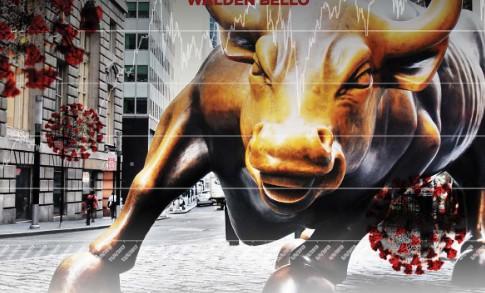

After COVID-19: Can we tame global finance?

- Análisis

The Covid-19 pandemic has brought the financial sector to a halt, much as it has the real economy.

The volatile dynamics that have produced crisis after crisis are thus temporarily frozen. The question is: Will governments take advantage of the interruption to put their financial houses in order so as to prepare them for the resumption of financial activity once the pandemic is under control?

This report by Focus on the Global South starts by showing how, prior to the pandemic, most of the reforms that were needed to prevent a repetition of the 2008-2009 financial crisis were not in place. For instance, investment instruments such as derivatives that had played such a key role in the 2008-2009 crisis, were still being traded. The “too big to fail” conundrum had, in fact, become worse, with more assets being concentrated in the top tier banks than before the crisis. To complicate things, there were new destabilizing elements that were not present during the Global Financial Crisis, the most important of which was China’s overheated financial sector.

The report then proceeds to list the 10 necessary reforms, giving in detail the reasons for each of them. The reforms, it notes, are changes that are non-neoliberal but they can be accommodated within a reformed capitalist system, though progressive alliances will need to be formed to secure them.

https://focusweb.org/wp-content/uploads/2020/08/A4_AfterCovid19_WEB.pdf

Del mismo autor

- Agrocide in the Philippines and how to stop it 13/08/2021

- Philippine agriculture is dying, what will it take to save it? 10/08/2021

- The Rise and Fall of Multilateralism 14/04/2021

- David slays Goliath in El Salvador 19/03/2021

- Leer a Piketty I: Un resumen conciso y exhaustivo de Capital e Ideología 12/03/2021

- Lecture de Piketty I: Un résumé concis et complet de Capital et idéologie 03/03/2021

- Reading Piketty II: Property, Ideology, and the Mystery of the Missing John Locke 23/02/2021

- Reading Piketty I: A Concise and Comprehensive Summary of Capital and Ideology 19/01/2021

- El asalto al Capitolio indica que EE.UU. ha entrado en la era de Weimar 07/01/2021

- United States: Storming of Capitol shows America has entered the Weimar era 07/01/2021

Clasificado en

Clasificado en:

Crisis Económica

- Geraldina Colotti 07/04/2022

- Julio C. Gambina 07/04/2022

- Rafael Bautista S. 06/04/2022

- Julio Gambina 04/04/2022

- José Ramón Cabañas Rodríguez 01/04/2022

Poscovid19

- Alastair Crooke 11/01/2022

- Michael Roberts 03/01/2022

- Armando Negrete 24/08/2021

- Armando Negrete 24/08/2021

- Boaventura de Sousa Santos 27/07/2021