From the Global North to the Global South: debt in its many states (second part)

The debt in the North: some alternative paths

01/01/2011

- Opinión

I. Debt over the last few decades :

The debt in the North, i.e. in the most industrialized countries,[1] began to reach high levels in the 1980s. And with reason. Following the first oil crisis and the 1973-1975 economic crisis, governments tried giving a Keynesian boost to the economy and resorted to borrowing. Debt servicing then soared when the US Federal Reserve suddenly raised interest rates (October 1979) thus marking a break from the past 46 years of Keynesian policy initiated in 1933 during Franklin Roosevelt's first term.

From the late 1980s to the early 2000s, the state of public finances deteriorated to different degrees depending on the countries considered. The main reason for this was the “tax counter-reform” implemented in favour of companies and high-income households, which resulted in declining revenues derived from corporate and individual income tax. This was offset on the one hand by a rise in indirect taxes (VAT) and on the other hand by increased borrowing. With the current crisis, which started in 2007, the state of public finances suddenly and tragically worsened, in particular owing to State interventions to bail out the bankrupt banks. In countries like the United Kingdom, the Netherlands and Ireland, governments committed huge amounts of public money to rescue the banks. In the medium term, the Spanish government is likely to do the same in order to bail out regional savings banks which have been virtually bankrupted by the real estate crisis. Ireland is crippled by the debts of several large private banks that were nationalized by the State but without recovering the cost of the bailout from shareholder assets. The policies carried out since 2007 have dramatically worsened the state of public finances.[2]

II. The creditors of European debts are mainly European bankers

With the considerable amount of liquid assets placed at their disposal by the central banks in 2007-2009, the banks of Western Europe (especially the French and German banks,[3] but also Belgian, Dutch, British, Luxembourg and Irish banks...) lent huge sums (especially to the private sector but also to the public authorities) in the countries of the “EU periphery” such as Spain, Portugal and Greece (the banks thought it was risk-free) as well as to the former Soviet bloc countries of Central and Eastern Europe (in particular Hungary). This resulted in a sharp increase in the debt of these countries, especially private debt. It must be noted that euro membership earned some countries of the EU's periphery the confidence of the Western European bankers who granted them massive loans, thinking the big European countries would help them if they found themselves in trouble.

The three charts below show the nationality of foreign holders of the private and public debt securities of Spain, Portugal and Greece (which represent a large part of the external debt of the three countries): [4]

Chart 1. Foreign holders of Spanish debt securities (end of 2008)

Chart 2. Foreign holders of Portuguese debt securities (end of 2008)

It should be emphasized that in the case of Portugal and Spain, the securities held by France and Germany alone represent almost 50% of the total; in the case of Greece, they represent 41%. This casts a special light on the “leadership” of these countries and their devotion to the European cause...

There has also been a substantial increase in internal debt over the past ten years, and a large financialization of the economy in these three countries. The private sector debt has grown: borrowing for households, private companies and banks was cheap (interest rates have been low and inflation higher than in the most industrialized countries) and this private debt has been driving the economy in the three countries; the banks, thanks to a strong euro, were able to expand their activities abroad and fund their domestic activities at lower cost.

Rescuing US and Western European banks

The piling up of debts in the eurozone's periphery threatened the banks of the eurozone's core. This threat of a bank crisis was behind the intervention of the eurozone authorities in May 2010, followed by the one designed for Ireland in November 2010. The exposure of EU (and Swiss) banks to the so-called PIIGS countries[6] (Portugal, Ireland, Italy, Greece, Spain) is very high, as shown in the table below. Taken together, the credits held by the banks of the countries listed in the first column over the PIIGS amount to 21% of the creditor countries’ GDP. The exposure of the French banks to the PIIGS represents 37% of the French GDP, mainly concentrated on Italy and Spain. The Irish banks' exposure represents 43% of the Irish GDP (mainly concentrated on Italy and Spain). The Dutch banks' exposure amounts to 33% of the Dutch GDP (mainly concentrated on Spain and Italy). The Belgian banks' exposure represents 28% of the Belgian GDP (mainly concentrated on Ireland and Italy). The British banks' exposure represents 21% of the British GDP (mainly on Ireland and Spain). This data shows to what extent the European financial sectors are intertwined and the propagation risk involved. A domino effect can rapidly and inexorably be triggered unless banks are forced to write off a considerable amount of credits from their balance sheets through debt cancellations.

Debts held by banks as a percentage of creditor countries’ GDP

|

Debts held by banks in :

|

Credits to :

|

|||||

|

|

Greece

|

Portugal

|

Spain

|

Ireland

|

Italy

|

Total PIIGS

|

|

Austria

|

1.3

|

0.8

|

2.5

|

2.4

|

7.2

|

14

|

|

Belgium

|

0.8

|

0.7

|

5.0

|

14.1

|

6.9

|

28

|

|

Denmark

|

0.1

|

0.1

|

0.8

|

7.3

|

0.2

|

8

|

|

France

|

3.1

|

1.8

|

8.9

|

2.5

|

20.8

|

37

|

|

Germany

|

1.5

|

1.5

|

6.2

|

6.0

|

6.2

|

21

|

|

Greece

|

0.0

|

0.0

|

0.1

|

0.3

|

0.2

|

1

|

|

Ireland

|

4.0

|

2.6

|

14.5

|

0.0

|

22.1

|

43

|

|

Italy

|

0.4

|

0.3

|

1.6

|

0.9

|

0.0

|

3

|

|

Netherlands

|

1.6

|

1.7

|

16.4

|

4.2

|

9.4

|

33

|

|

Portugal

|

4.7

|

0.0

|

13.4

|

10.3

|

2.5

|

31

|

|

Spain

|

0.1

|

6.4

|

0.0

|

1.2

|

3.5

|

11

|

|

Sweden

|

0.2

|

0.1

|

1.6

|

1.3

|

0.7

|

4

|

|

Switzerland

|

0.8

|

0.9

|

4.0

|

3.6

|

3.6

|

13

|

|

United Kingdom

|

0.8

|

1.2

|

5.7

|

9.4

|

3.8

|

21

|

|

European banks

|

1.3

|

1.7

|

6.0

|

4.5

|

7.3

|

21

|

Source: BIS- Consolidated foreign claims of reporting banks – end of 2009 (as a % of GDP)

In May 2010, US president Barack Obama put pressure on Angela Merkel, Nicolas Sarkozy and the other European leaders because US banks were also highly exposed. They had used the aid provided by Washington from the end of 2008 to increase their positions in the EU, mainly in Germany and France where the banks were themselves heavily exposed to the periphery. If a crisis had broken out in the EU, the US banks would have definitely been hit by the boomerang effect.

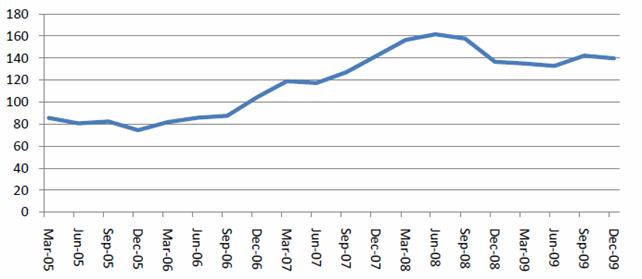

In the chart below, the blue curve shows the evolution of European bank assets in the United States between March 2005 and December 2009 (the unit being 1,000 billion dollars). The red curve shows the assets of US banks in the EU. It is clear that from December 2008, US bank assets in the EU increased whereas from September 2008 (Lehman Brothers' bankruptcy), the European banks began to withdraw (even if their exposure to the US remains very high).

The price to pay for EU (and IMF) intervention comes in the form of austerity plans, in the EU periphery as well as in its core countries, which will have 5 major consequences: 1. they will prolong the crisis by compressing global demand; 2. they will weaken social protection mechanisms, and aggravate the poverty and precarity of the victims of the crisis; 3. they will strengthen the domination of the financial corporations, and thus of Capital, over society and States through the pressure (or even blackmail) they never fail to exert thanks to their position as creditors; 4. they will reduce the States’ capacity to comply with their obligations with respect to basic human rights and intensify the trend to use repression as a response to social protests; 5. they will also reduce the States’ capacity to comply with their international obligations in the field of official development aid, of providing relief assistance to the victims of natural disasters in the South and contributing to the struggle against climate change.

Austerity measures will plunge one million British people into poverty, a study says.

The stringent austerity measures taken by the British government will plunge nearly one million people into absolute poverty, says the Institute for Fiscal Studies (IFS), an independent and highly respected research institute.

By the end of 2014, 900,000 people will fall into the “absolute poverty” category, consisting of households having real incomes of less than 60% of the 2010-2011 average income, according to IFS calculations.

This serious deterioration will result among other things in growing proverty among chidren for the first time in fifteen years: in 2012-2013, there will be 200,000 more of them living in “absolute poverty”. Another 300,000 children will fall into that category in 2013-2014, according to the IFS.

“This finding is at odds with the government’s claims that its reforms will have no measurable impact on child poverty in 2012-2013”, says the IFS study. The government of Tory Prime Minister David Cameron has implemeted a far-reaching austerity plan, considered to be the harshest of the big EU countries, which aims at saving 81 billion pounds (about 92 billion euros) in less than five years. The plan also includes a tax increase of 30 billion pounds to bring back the deficit to 1.1% of GDP by 2015, down from 10.1% this year.

The austerity plan includes cuts in social benefits, especially in housing.

The Exchequer considered the IFS study contained “considerable uncertainties”.

Source : Agence France Presse (AFP). Dispatch of 17 December 2010.

II. Greece: the very symbol of illegitimate debt

The Greek public debt made the headlines when the country’s leaders accepted the austerity measures demanded by the IMF and the European Union, sparking very significant social struggles throughout 2010. But where does this Greek debt come from? As regards the debt incurred by the private sector, the increase has been recent: the first surge came about with the integration of Greece into the eurozone in 2001. A second debt explosion was triggered in 2007 when financial aid granted to banks by the US Federal Reserve, European governments and the European Central Bank was recycled by bankers towards Greece and other countries like Spain and Portugal. As regards public debt, the increase stretches over a longer period. In addition to the debt inherited from the dictatorship of the colonels, borrowing since the 1990s has served to fill the void created in public finances by lower taxation on companies and high incomes. Furthermore, for decades, many loans have financed the purchasing of military equipment, mainly from France, Germany and the United States. And one must not forget the colossal debt incurred by the public authorities for the organization of the Olympic Games in 2004. The spiraling of public debt was further fueled by bribes from major transnationals to obtain contracts, Siemens being an emblematic example.

This is why the legitimacy and legality of Greece’s debts should be the subject of rigorous scrutiny, following the example of Ecuador’s comprehensive audit commission of public debts in 2007-2008. Debts defined as illegitimate, odious or illegal would be declared null and void and Greece could refuse to repay, while demanding that those who contracted these debts be brought to justice. Some encouraging signs from Greece indicate that the re-challenging of debt has become a central issue and the demand for an audit commission is gaining ground.

Factors proving the illegitimacy of Greece’s public debt

Firstly, there is the debt contracted by the military dictatorship and which quadrupled between 1967 and 1974. This obviously qualifies as odious debt[8].

Following on, we have the Olympic Games scandal of 2004. According to Dave Zirin, when the government proudly announced to Greek citizens in 1997 that Greece would have the honour of hosting the Olympic Games seven years hence, the authorities of Athens and the International Olympic Committee planned on spending 1.3 billion dollars. A few years later, the cost had increased fourfold to 5.3 billion dollars. Just after the Games, the official cost had reached 14.2 billion dollars[9]. Today, according to different sources, the real cost is over 20 billion dollars.

Many contracts signed between the Greek authorities and major private foreign companies have been the subject of scandal for several years in Greece. These contracts have led to an increase in debt. Here are some examples which have made the main news in Greece:

- several contracts were signed with the German transnational Siemens, accused - both by the German as well as the Greek courts - of having paid commissions and other bribes to various political, military and administrative Greek officials amounting to almost one billion euros. The top executive of the firm Siemens-Hellas[10], who admitted to having “financed” the two main Greek political parties, fled in 2010 to Germany and the German courts rejected Greece’s demand for extradition. These scandals include the sales, made by Siemens and their international associates, of Patriot antimissile systems (1999, 10 million euros in bribes), the digitalization of the OTE - the Hellenic Telecommunications Organization - telephone centres (bribes of 100 million euros), the “C41” security system bought on the occasion of the 2004 Olympics and which never worked, sales of equipment to the Greek railway (SEK), of the Hermes telecommunications system to the Greek army, of very expensive equipment sold to Greek hospitals.

- the scandal of German submarines (produced by HDW, later taken over by Thyssen) for a total value of 5 billion euros, submarines which from the beginning had the defect of listing to the left (!) and which were equipped with faulty electronics. A judicial enquiry on possible charges (of corruption) against the former defence ministers is currently under way.

It is absolutely reasonable to presume that the debts incurred to clinch these deals are founded in illegitimacy, if not illegality. They must be cancelled.

Beside the above-mentioned cases, one must also consider the recent evolution of the Greek debt.

The rapid rise in debt over the last decade

Debt in the private sector has largely developed over the decade of the noughties. Households, to whom the banks and the whole private commercial sector (mass distribution, the automobile and construction industries, etc.) offered very tempting conditions, went massively into debt, as did the non-financial companies and the banks which could borrow at low cost (low interest rates and higher inflation than for the most industrialized countries of the European Union like Germany, France, the Benelux countries and Great Britain). This private debt was the driving force of the Greek economy. The Greek banks (and the Greek branches of foreign banks), thanks to a strong euro, could expand their international activities and cheaply finance their national activities. They took out loans by the dozen. The chart below shows that Greece’s accession to the eurozone in 2001 has boosted an inflow of financial capital, which can be in the form of loans or portfolio investments (Non-FDI in the chart, i.e. inflows which do not correspond to long term investments) while the long term investments (FDI- Foreign Direct Investment) have remained stagnant.

With the vast amounts of liquidity made available by the central banks in 2007-2009, the Western European banks (above all the German and French banks, but also the Belgian, Dutch, British, Luxembourg and Irish banks) lent extensively to Greece (to the private sector and to the public authorities). One must also take into account that the accession of Greece to the euro bolstered the faith of Western European bankers who thought that the big European countries would come to their aid in case of a problem. They did not worry about Greece’s ability to repay the capital lent in the medium term. The bankers considered that they could take very high risks in Greece. History seems to have proved them right up to that point. The European Commission and, in particular, the French and German governments have given their unfailing support to the private banks of Western Europe. In doing so, the European governments have placed their own public finances in a parlous state.

In the chart below we see that the countries of Western Europe first increased their loans to Greece between December 2005 and March 2007 (during this period, the volume of loans grew by 50%, from less than 80 billion to 120 billion dollars). After the subprime crisis started in the United States, the loans increased dramatically once again (+33%) between June 2007 and the summer of 2008 (from 120 to 160 billion dollars). Then they stayed at a very high level (about 120 billion dollars). This means that the private banks of Western Europe used the money which was lent in vast quantities and at low cost by the European Central Bank and the US Federal Reserve in order to increase their own loans to countries such as Greece[12]. Over there, where the rates were higher, they could make juicy profits. Private banks are therefore in large part responsible for Greece’s excessive debt.

Evolution of Western European banks’ exposure to Greece

(in billion dollars)

Source: BIS consolidated statistics, ultimate risk basis[13]

Greek citizens have every right to expect the debt burden to be radically reduced, which means that the bankers must be forced to write off debts from their ledgers.

The odious attitude of the European Commission

After the crisis broke, the military-industrial lobby supported by the German and French governments and the European Commission saw to it that hardly a dent was made in the defense budget while at the same time, the PASOK (Socialist Party) government set about trimming social spending (see the box on austerity measures below). Yet at the beginning of 2010, at the height of the Greek crisis, Recep Tayyip Erdogan, Prime Minister of Turkey, a country which has a tense relationship with its Greek neighbour, visited Athens and proposed a 20% cut in the military budget of both countries. The Greek government failed to grab the line thrown to them. They were under pressure from the French and German authorities who were anxious to safeguard their weapons exports. In proportion to the size of its economy, Greece spends far more on armaments than the other EU countries. Greek military spending represents 4% of its GDP, as compared to 2.4% for France, 2.7% for the United Kingdom, 2.0% for Portugal, 1.4% for Germany, 1.3% for Spain, and 1.1% for Belgium.[14] In 2010, Greece bought six frigates (2.5 billion euros) and armed helicopters (400 million euros) from France. From Germany it bought six submarines for 5 billion euros. Between 2005 and 2009, Greece was one of Europe’s five largest weapons importers. The purchase of fighter aircraft alone accounted for 38% of its import volume, with, for instance, the purchase of sixteen F-16 (from the United States) and twenty-five Mirage 2000 (from France) – the latter contract amounting to 1.6 billion euros. The list of French equipment sold to Greece goes on: armoured vehicles (70 VBL), NH90 helicopters, MICA, Exocet and Scalp missiles as well as Sperwer drones. Greece’s purchases have made it the third biggest client of the French military industry over the past decade.[15]

From 2010, increasingly high interest rates charged by bankers and other players in the financial markets, supported by the European Commission and the IMF, have triggered the usual “snowball effect” : the Greek debt has followed an upward trend as the country’s authorities take out loans in order to repay interest (and part of the previously borrowed capital).

The loans granted as from 2010 to Greece by EU member countries and the IMF will not serve the interests of the Greek people - quite the opposite. The austerity measures implemented entail numerous infringements of the people’s social rights. On that grounds,[16] the notion of “illegitimate debt” should be applied and its repayment contested.

Infringement of social rights and neo-liberal measures implemented in Greece since 2010

Reduction of public sector wages by 20 to 30 %. Cuts in nominal wages that could reach 20%, 13th and 14th month salaries replaced by an annual lump sum, the amount of which varies according to wages. A freeze on wages over the next 3 years. In the public sector, 4 out of 5 workers who retire will not be replaced. In the private sector, massive wage cuts up to 25%.

Unemployment benefits have been cut, and a poverty support scheme implemented in 2009 has been suspended. Drastic cuts in benefits for large families.

Plans to end collective bargaining and impose individualized contracts instead. The existing practice of extended very low paid or even unpaid internships has been legalized. Resorting to temporary workers is now permitted in the public sector.

Employment

Drastic cuts in subsidies to municipalities, leading to mass lay-offs of workers. Sacking of 10,000 workers under fixed term contracts in the public sector. Public companies showing a loss to be closed down.

Taxes

Increase in indirect taxation (VAT raised from 19% to 23% and special taxes on fuels, alcohol and tobacco introduced). Increase from 11% to 13% of the lower VAT rate (this concerns staple goods, electricity, water, etc.). Increased income tax for the middle brackets, but reduced corporate tax.

Privatizations

Intention to privatize the ports, airports, railways, water and electricity supply, the financial sector and the lands owned by the State.

Pension schemes

Pensions are to be cut and then frozen. The legal retirement age has been increased, the number of years’ contributions required to be entitled to full pension benefits will be set at 40 in 2015 up from 37, and the amount of pension will be calculated on the average wages of the total working years and no longer on the last pay. For retired workers in the private sectors, the 13th and 14th month pension payments have been abolished. Spending related to pension has been capped to a maximum level of 2.5% of GDP.

Public transport fares

Price of all public transport fares increased by 30%.

The demand for an audit is gathering momentum

In December 2010, the independent MP Sophia Sakorafa made a speech in the Greek Parliament proposing the creation of a Parliamentary Commission to audit the Greek public debt. This proposal attracted a great deak of attention.[17] Sophia Sakorafa, who was a member of the government party PASOK until a few months ago, voted against the 2011 budget[18] partly because of the heavy debt repayments. When justifying her brave position, she extensively referred to the audit carried out in Ecuador in 2007-2008 which resulted in a significant reduction of the country’s debt. She proposed that Greece should follow the Ecuadorian example and asserted that there was an alternative to submitting to creditors, whether IMF or bankers. In making her case she placed stress on the “odious debt” that should not be repaid. This stance was widely covered by the media. Again in the Greek parliament, the leader of Synaspismos (one of the radical left parties) Alexis Tsipras also asked for an audit commission to be set up “so that we know which part of the debt is odious, illegitimate and illegal.” Greek public opinion is changing and the media are watching.

Trade unions, several political parties and many intellectuals support this proposal as a means of finding a solution to debt through cancellation on the one hand, and penalization of companies and people responsible for this illegitimate debt on the other. It should be noted that a Greek anti-debt committee was set up in 2010.[19]

IV. The Irish crisis: a complete failure for neo-liberalism[20]

For a decade, Ireland was heralded by the most ardent partisans of neo-liberal capitalism as a model to be imitated. The Celtic Tiger boasted a higher growth rate than the European average. The tax rate on companies had been reduced to 12.5%[21] and the rate actually paid by TNCs that had set up business there was between 3 and 4% - a CEO’s dream! Ireland’s budget deficit was nil in 2007, as was its unemployment rate in 2008. In this earthly paradise, everybody seemed to benefit. Workers had jobs (though often highly precarious), their families were busy consuming, benefiting as they were from the prevailing abundance, and both local and foreign capitalists were enjoying inordinate returns.

In October 2008, a couple of days before the Belgian government bailed out the big “Belgian” banks Fortis and Dexia with taxpayers’ money, Bruno Colmant, head of the Brussels stock exchange and professor of economics, published an op-ed in Le Soir, the French-language daily newspaper of record, stating that Belgium imperatively had to follow the Irish example and further deregulate its financial system. According to Colmant, Belgium needed to change the legal and institutional framework so as to become a platform for international capital, just like Ireland. A few short weeks later the Celtic Tiger was crying mercy.

In Ireland, financial deregulation had triggered a boom in loans to households (household indebtedness had reached 190% of GDP on the eve of the crisis), particularly in real estate, a factor that helped boost the island’s economy (the building industry, financial activities, etc.). The banking sector had experienced exponential growth with the establishment of many foreign companies[22] and the increase in Irish banks’ assets. Real estate and stock market bubbles started forming. The total amount of stockmarket capitalizations, bond issues and bank assets was fourteen times bigger than the country’s GDP.

What could not possibly happen in such a fairytale world then happened: in September-October 2008 the card castle collapsed and the real estate and financial bubbles burst. Companies closed down or left the country, unemployment rose from 0% in 2008 to 14% in early 2010. The number of families unable to repay their creditors swiftly increased too. The whole Irish banking system teetered on the edge of bankruptcy and a panic-stricken government blindly guaranteed bank deposits for 480 billion euros (that is, about three times an Irish GDP of 168 billion). It nationalized the Allied Irish Bank, the main source of financing for real estate loans, with a transfusion of 48.5 billion euros (about 30 % of GDP).

Exports slowed down. State revenues declined. The budget deficit rose from 14% of GDP in 2009 to 32% in 2010 (more than half of this due to the massive support given to the banks: 46 billion in equity and 31 billion in purchases of toxic assets).

At the end of 2010 the European bail-out plan with IMF participation amounted to 85 billion euros in loans (including 22.5 billion from the IMF) and it is already clear that it will not be enough. In exchange, a radical cure was enforced upon the Celtic Tiger in the form of a drastic austerity plan that heavily affects households’ purchasing power, with a resultant decrease in consumption, in public expenditure on welfare, in civil servants’ salaries, in infrastructure investments (to facilitate debt repayment), and in tax revenues. On the social level, the principal measures of the austerity plan are nothing short of disastrous:

- suppression of 24,750 positions in the civil service (8% of the workforce, which would mean 350,000 positions in France);

- newly recruited employees will earn 10 % less;

- reduction of social transfers resulting in lower family and unemployment allowances, a significant reduction in the health budget, a freeze on retirement pensions;

- a rise in taxes, to be borne mostly by the majority of the population, already a victim of the crisis: notably a VAT increase from 21% to 23% in 2014; creation of a real estate tax (affecting half of the households that were formerly tax-exempt);

- a 1 euro reduction in the minimumhourlywage (from 8.65 to 7.65 euros, or 11% less).

The rates for loans to Ireland are very high: 5.7% for the IMF loan and 6.05% for “EU” loans. These loans will be used to repay banks and other financial bodies that buy bonds on the Irish debt, borrowing money from the European Central Bank at a rate of 1 % - another windfall for private financiers. According to AFP, IMF managing director Dominique Strauss-Kahn claimed that it would work, though of course “it would be difficult because it is hard for people who will have to make sacrifices for the sake of budget austerity”.

Both in the streets and in parliament, opposition has been very determined. The Dail, or lower house of parliament, voted the 85 billion rescue plan by a mere 81 to 75. Far from relinquishing its neo-liberal orientation, the IMF declared that among Ireland’s priorities it is counting on the adoption of reforms to do away with structural obstacles to business, so as to support competitiveness in the coming years. “Socialist” Dominique Strauss-Kahn said he was convinced that a new government after the elections in early 2011 would not change anything: “I'm confident that even if the opposition parties, Fine Gael and Labour, are criticizing the government and the programme [...], they understand the need to implement the programme.”

In short, the economic and financial liberalization aimed at attracting foreign investments and transnational financial companies has utterly failed. To add insult to the damage the population must bear as a result of such a policy, the IMF and the Irish government are persevering in the neo-liberal orientation of the past two decades and, under pressure from international finance, are subjecting the population to a structural adjustment programme similar to those imposed on Third World countries for the past three decades. Yet these decades should show what must not be done, and why it is high time to enforce a radically different logic that benefits people and not private money.

V. Contrary to popular belief, private debt is much higher than public debt

Major media and governments claim that in the North, the issue is the burden of public debt while in fact in most countries, private debt is much heavier. For instance, private debt accounts for 83% of Spain’s, 85% of Portugal’s and 58% of Greece’s total debt.[23] Also for 89% in Britain, 76% in France, 66% in Italy, 75% in Germany, 79% in the US and 59% in Japan.[24] This huge private debt, particularly that of private companies, may well turn into part of our public debt tomorrow, as happened in 2007-2009, unless we watch out. Now a heavier public debt is used by current governments as an argument that would account for adopting new austerity plans primarily affecting social expenditure.

Let us look at the case of Ireland. If you ask people who get their information from the mainstream media whether Ireland’s external debt is mainly public debt, they are very likely to give a positive answer. Yet Ireland’s public external debt accounts for only 4.6% of the total external debt of the dying ‘Celtic Tiger.’ The chart below gives the proportion of external debt that is the government’s responsiblity.[25]

Proportion of external debt that is the government’s responsiblity

(in % of the total external debt)

|

Austria

|

27.29%

|

|

Belgium

|

22.41%

|

|

Canada

|

23.62%

|

|

Czech Republic

|

22.54%

|

|

Denmark

|

6.90%

|

|

France

|

27.10%

|

|

Germany

|

25.45%

|

|

Icelande

|

4.70%

|

|

Ireland

|

4.61%

|

|

Italy

|

46.22%

|

|

Japan

|

31.81%

|

|

South Korea

|

8.77%

|

|

Netherlands

|

13.75%

|

|

Norway

|

16.17%

|

|

Poland

|

31.49%

|

|

Portugal

|

21.76%

|

|

Spain

|

16.72%

|

|

Sweden

|

7.79%

|

|

United Kingdom

|

5.16%

|

Source : FMI, http://dsbb.imf.org/Pages/SDDS/ExternalDebt.aspx. The figures are for the second term in 2010.

Note that the share of private debt in total debt has risen steeply since the end of the 1990s.

VI. Joseph Stiglitz and other economists support the position of those who argue for suspension of debt repayment

1. Joseph Stiglitz, 2001 laureate of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel,chair of President Bill Clinton’s Council of Economic Advisors from 1995 to 1997, chief economist and vice-president of the World Bank from 1997 to 2000, gives strong arguments to those who seek a suspension of public debt repayment. In a collective book published by OUP in 2010,[26] he claims that Russia in 1998 and Argentina in the 2000s are proof that a unilateral suspension of debt repayment can be beneficial for countries that make this decision: “Both theory and evidence suggest that the threat of a cut-off of credit has probably been exaggerated.” (p.48).

When a country succeeds in enforcing debt relief on its creditors and uses funds that were formerly meant for repayment in order to finance an expansionist tax policy, this yields positive results: “Under this scenario the number of the firms that are forced into bankruptcy is lowered, both because of the lower interest rates[27] and because of the improved overall economic performance of the economy that follows. As the economy strengthens, government tax revenues are increased – again improving the fiscal position of the government. […] All this means that the government’s fiscal position is stronger going forward, making it more (not less) likely that creditors will be willing to again provide finance.” (p.48) He adds: “Empirically, there is little evidence in support of the position that a default leads to an extended period of exclusion from the market. Russia returned to the market within two years of its default which was admittedly a ‘messy one’ involving no prior consultation with creditors […] Thus, in practice, the threat of credit being cut off appears not to be effective.” (p.49)

Joseph Stiglitz considers that those who believe that one of the central functions of the IMF is to impose the highest possible price on countries that wish to default are wrong. “The fact that Argentina did so well after its default, even without an IMF program, (or perhaps because it did not have an IMF program) may lead to a change in these beliefs.” (p.49)

Joseph Stiglitz also clearly challenges the part played by bankers and other creditors who granted massive loans without checking the solvability of borrowing countries or, worse, who granted their loans while knowing full well that there was a high defaulting risk. He adds that since creditors demand high rates from some countries to compensake for risk it is only right that they should accept losses due to debt cancellation. Those creditors should have used the high interests they received as a provision against possible losses. He also exposes ‘raider’ loans all too lightly granted by bankers to indebted countries (p.55).

In short, Stiglitz argues that creditors should take responsibility for the risks they run (p.61). Towards the end of his contribution he claims that countries that choose to default or renegotiate debt relief will have to enforce a temporary control on currency exchange and /or taxes to prevent a capital drain (p.60). He is in favour of the doctrine of odious debt and claims that such debt must be cancelled (p.61).[28]

2. In an article published in Journal of Development Economics[29] under the title ‘The Elusive Costs of Sovereign Defaults,’ Eduardo Levy Yeyati and Ugo Panizza, two economists who worked for the Inter-American Development Bank, set out the findings of their thorough enquiry into defaulting in some forty countries. One of their main conclusions is that ‘Default episodes mark the beginning of the economic recovery.’ It couln’t be better put.

VII. Alternatives

In August 2010, CADTM put forward eight measures related to the current crisis in Europe.[30]The central proposal as far as debt is concerned is a unilateral moratorium on debt repayment allowing the debtor country to carry out an audit of the public debt under citizen scrutiny.

Below are the 8 measures proposed by CADTM and submitted for discussion to all movements and parties that believe a popular riposte is needed to counter Capital’s opportunistic exploitation of the debt explosion.

1. Announce a unilateral moratorium (without accrual of interest on overdue payments) on debt repayments, while an audit of the public debt is carried out (with citizen participation). On the basis of the results of this audit, debt identified as illegitimate will be cancelled.

With its experience in analyzing the debt issue in the South, CADTM warns against making insufficient demands such as the mere suspension of debt repayment. There must be a moratorium on all repayments including overdue interest on sums not repaid.

The moratorium will be used to conduct a review of loans in order to identify illegitimate debts. Citizen participation is an essential requirement to ensure the objectivity and transparency of the audit. The audit commission should be composed of experts in auditing public finances, economists, trade unionists and social movement representatives among others. The audit will make it possible to identify the different responsibilities in the debt processs and demand that those responsible be held publicly accountable. Debts identified as odious or illegitimate will be cancelled.

2. Expropriate the banks without compensation and transfer them to the public sector under citizen control.

There is no sustainable regulation possible with private financial institutions. States must recover their capacity to control and direct economic and financial activities. The cost of taking over virtually bankrupt private banks must be recovered from the general assets of the major shareholders. For the private companies that have shares in the banks and led them to the verge of ruin while making juicy profits have assets in other economic sectors. The general assets of the big shareholders must therefore be tapped. The idea is to avoid making the people pay for losses. The Irish example is emblematic: the way the Irish Allied Bank was nationalized is unacceptable. Lessons must be learned from it.

3. Establish true European fiscal justice and fair redistribution of wealth. Ban legal and tax havens. Tax financial transactions heavily.

Together with a harmonization of European taxation in order to stop tax dumping, a radical reform of taxation is needed. The goal is increased public revenues, particularly through income and corporate tax, and a rapid decrease in the prices of basic goods and services (food, water, electricity, heating, public transport, etc.) by a sharp, targeted reduction of VAT on these vital goods and services.

Since 1980, the rates of direct taxation on the highest incomes and the big corporations have been falling. For instance, in the EU between 2000 and 2008 the higher income tax rate and coroporate tax rate fell by 7 and 8.5 points respectively. Those hundreds of billions of euros in tax breaks have been largely oriented toward speculation and the accumulation of more wealth by the richest.

There must be a ban on all transactions passing through tax havens, which causes the countries North and South to lose resources each year that are crucial for social development. The G20 countries have repeatedly refused, despite their declarations of intent, to effectively tackle legal and tax havens. These dark chasms of financial corruption, crime and high level illicit trafficking must be banned. As well as the gradual increase in taxation, there should be dissuasive taxation on speculative transactions and on the income of debt creditors.

4. Fight the massive tax evasion of big business and the rich.

Tax evasion considerably reduces public resources and deprives the community of employment opportunities. Adequate public resources must be allocated for the effective repression of this type of fraud. The results should be made public and the perpetrators severely punished.

5. Rein in the financial markets, particularly by creating a register of security holders and prohibiting short sales.

Worldwide speculation represents several times the wealth produced on the planet. The highly complex nature of this financial engineering makes it totally uncontrollable The mechanisms that are put into motion de-construct the productive economy. Opacity in financial transactions is the rule. To tax the creditors at the source they must be identified. The dictatorship of financial markets must cease.

6. Drastically reduce working time to create jobs and increase wages and pensions.

Spreading the wealth differently is the best response to the crisis. The share of produced wealth going to employees has decreased significantly, while creditors and businesses have increased their profits and levels of speculation. Increasing wages not only allows people to live with dignity; it also enhances the means of providing social protection and pension schemes.

Reducing working time without reducing wages and creating jobs also enhances the quality of life of the population.

7. Resocialize the many businesses and services privatized over the past 30 years.

A feature of the past 30 years has been the privatization of many businesses and public services. From the banks to industry, postal services, telecommunications, energy and transport, governments have delivered whole sections of the economy to the private sector, losing all possibility of control and regulation. These public goods and services, produced by collective effort, must be returned to the public domain. New public services must be created according to the people’s needs, and particularly in response to climate change (creation of a public insulation service).

8. A constituent assembly of the peoples for a different European Union.

The EU forced on European populations through constitutional treaties is a powerful war machine serving capital and finance. It must be completely re-shaped by a constituent process where the voices of the peoples are finally taken into account. This new democratized Europe must work, in CADTM’s opinion, towards upward harmonization of fiscal and social justice, encourage a higher standard and quality of life for its inhabitants, withdraw its troops from Afghanistan, leave NATO, slash military spending, ban nuclear weapons, firmly commit itself to disarmament, end the ‘siege mentality’ policy towards potential immigrants, and become a fair and supportive partner in solidarity with the peoples of the South.

Breaking the domination of big business

The financial institutions behind the crisis enrich themselves and speculate on sovereign debts with the active complicity of the European Commission, the European Central Bank and the IMF, to meet the interests of big shareholders and creditors. This private gain, allowable through tax breaks and regressive social legislation and then accelerated by government austerity plans, must cease.

The reduction of public deficits should not be achieved by reducing social spending, but by increased tax revenue through higher taxes on capital (business and financial capital) and income, on the assets of the wealthy and on financial transactions. This means breaking with capitalist logic and imposing radical social change. As opposed to the capitalism we currently live under, the new logic will break with productivism, integrate new ecological factors, and fight all forms of oppression (racial, patriarchal, etc.).

Our demands work towards an effective response to the crisis, in the interest of the people. Cancelling illegitimate debt is a matter for State sovereignty.

In a united anti-crisis front, we plan to assemble the various energies required, not only at European level but also locally, to create a balance of power favourable to the implementation of radical solutions focused on social justice.

Throughout history there have been numerous examples of debt abolition in countries in the South and North, sometimes unilaterally, sometimes as a result of court decisions, sometimes granted under pressure by the dominant powers.

International law is full of doctrines and jurisprudence that can facilitate, and in fact have facilitated, debt cancellation or repudiation.

A casebook example: CADTM actively participated in the audit of the debt of Ecuador in 2007-2008. This audit enabled the Ecuadorian government to force its creditors to sell securities to the State worth 3.2 billion dollars with a 70% discount (put simply, the State bought back for 30 dollars a bond whose face value was 100 dollars). This represented a 30 percent reduction of its external public debt. [32]This also enabled the State to save 300 million dollars a year in interest for 20 years - a very substantial sum. This money is now spent on improving public health and education and on new jobs. In recent years other countries have successfully imposed unilateral moratoriums on the repayment of their debt: Russia in 1998, Argentina in 2001-2005 with 80 billion dollars of debt securities sold to banks and other foreign investors (mainly German, Itlaian, and US). Since 2001 Argentina has suspended payments to the Paris Club for an amount of 6.5 billion dollars and is in excellent health. It was as late as October 2010 that it officially resumed negotiations with its bilateral creditor members of the Club, imposing a condition that the IMF stay out of the negotiations.

These measures, insufficient though they may be, mark significant advances that can be used by social movements in the South and North to demand total and unconditional cancellation of illegitimate debt.

This cancellation is now a necessity and an urgency, given how seriously the sums spent in servicing debts restrict the economic, social and cultural rights of populations, while reinforcing Capital’s nuisance potential.

VIII. A process of convergence is currently under way

Fortunately, since September 2010, we have been witnessing a process of convergence between CADTM and other movements on ways to confront the issues of public debt and its exploitation by governments to introduce veritable structural adjustment plans. Here are some examples of this process :

1. In the “Manifesto of the appalled economists”[33] launched in September 2010 and signed by more than 2,700 economists as well as various activists, among the 22 concrete proposals for getting out of the crisis, two are partially in line with those put forward by CADTM:

“Measure 9 : Conduct a public, citizen audit of public debts in order to determine their origin and identify the main holders of debt securities, as well as the amounts held.

Measure 15 : If necessary, restructure the public debt, for example by capping the service of public debt to a certain percentage of GDP, and by discriminating creditors according to the volume of shares they hold. In fact, very large stockholders (individuals or institutions) must accept a substantial lengthening of the debt profile, and even partial or total cancellation. We must also renegotiate the exorbitant interest rates paid on bonds issued by countries in trouble since the crisis.”

2. On 24 September 2010, ATTAC Spain took the following stand on Greece: “In Greece, the opaque, secret and criminal association between Goldman Sachs and the previous conservative government deceived Greek and European citizens, with the complicity of the French and German banks. The rescue package allowed these German and French banks to make good their losses, while Goldman Sachs and the former political leaders freely enjoy the use of their loot. The fair answer consisted and still consists in the first place of issuing an international arrest warrant for the people responsible so that they be tried for their crimes; then in demanding that an audit of this debt be carried out in order to identify and recognize only the fair part of it, and finally in prioritizing the social interests of the Greeks over the interests of the private international banks by reconsidering the budgets and the commitments made in relation to the purchase of new submarines from Germany.”

As far as Ireland is concerned, ATTAC Spain says: “In this case, there are also many reasons for sueing the current leaders and the board members of the private banks for their crimes. Refuse to continue paying the debt without a prior audit and prioritize the people’s interests over the interests of the speculators and market fundamentalists who lie and deceive us.”[34]

3. The Irish coalition “Debt and Development” has united several development NGOs and North/South solidarity organizations around a quite moderate platform which essentially focuses on better management of the loans granted to Southern countries. They have produced a 24-page document on the Irish crisis in which they ask for “key reforms in Irish government policy toward the IMF, central to which [is] an end to the IMF’s practice of attaching economic policy conditions to its loans.” [35] As for the main Irish trade union confederation, it demands that a 10% reduction in the value of public debt securities be imposed on their holders. [36]

4. In a release dated 30 November 2010, ATTAC France put forward six proposals/demands that CADTM can largely suscribe to (even if it is regrettable that the debt audit is not mentioned):

- “taxing and strictly regulating financial transactions, starting with transactions on the euro; prohibiting speculation on public debts; closing over-the-counter markets;

- forcing into bankruptcy the banks which are too heavily indebted, without compensating the creditors and shareholders who have accumulated profits by playing with fire;

- nationalizing the banks which have been bailed out with public funds; these banks will have to be promptly socialized, i.e. placed under the democratic control of workers, citizens and public authorities;

- -prohibiting deposit banks, which manage the savings of private individuals, to take speculative positions and to have subsidiaries in tax havens;

- restructuring the debt, or establishing a partial default for the States crippled with the public debt burden: debt which has been worsened by tax breaks for the rich, the financial crisis and the bailout of banks, is illegitimate;

- in addition, partial monetization of the public debt, the ECB buying State bonds directly from the States.”

5. On 5 December 2010, a leading Greek daily published an op-ed by the Greek economist Costas Lapavitsas entitled: “International Audit Commission on the Greek Debt”. In his conclusion, the author writes: “The international commission will have a privileged scope of activity in our country. You only need to think about the debt agreements made with Goldman Sachs’s mediation or intended to finance the purchase of weapons to see how badly an independent audit is needed. If they are proved to be odious or illegal, these debts will thus be declared null and our country could refuse to repay them, while taking the people who incurred them to court.”

6. On 17 December 2010, the European ATTAC network published a joint declaration[37]proposing real alternative measures, among which:

- “establish a default mechanism by which the States would repudiate all or part of their public debt caused by tax breaks benefiting the rich, the financial crisis and the prohibitive interest rates imposed by the financial markets;

- reform taxation so as to restore public revenues and make it fairer, by taxing movements of capital, large fortunes and high incomes, profit made by companies, towards the establishment of a maximum income.”

Here again, on the two points above, there are largely converging views between the European ATTAC network and the European CADTM network.

7. A few days later, Jean-Marie Harribey, former co-president of ATTAC France and a member of its scientific council, published an article titled “Serial killers must be nabbed” in which he proposes “collectivizing-socializing the whole banking system on a European scale.”

Two paragraphs we can wholly subscribe to are dedicated to debt:

“Cancel the illegitimate public debt

Everyone knows that increased public deficits and therefore increased public debt are not due to uncontrolled public spending. They are due to two factors. The first one has been operating pervasively for several decades, the French case being examplary in this respect: taxation has been reduced on all sides, particularly progressive taxation, without the successive governments managing to make similar, proportional cuts in public and social spending, a great part of which cannot be compressed. The second factor is recent and more violent: it is the endorsement of private debts by the public authorities in the wake of the banking and financial crisis.

It is therefore impossible to justify people’s being forced to bear the consequences of a situation they are in no way responsible for. Almost all of the public debt is illegitimate.”

Conclusion : Unquestionably, the public debt issue erupted in the North on the occasion of the serious global crisis that had its beginnings in 2007-2008. The lessons of thirty years of structural adjustment in the South must be learned and the peoples of Europe must mobilize massively to avoid decisions taken in the North being the mirror-image of decisions imposed on the South over the past three decades. Many movements are already raising the issue of the legitimacy of this debt and of the need for a comprehensive audit, so as to cancel the part that is illegitimate. This struggle is crucial for laying the basis of a radically different economic and financial logic. The public debt is a stranglehold that must be broken in the interest of the people, not the creditors. To begin implementing an economic and social policy that serves the people and tackles climate change, a radical reduction of the public debt is necessary. But this alone is not enough. It must go hand in hand with a whole series of radical reforms. Only mass mobilization driven by clear objectives can make this possible.

(Translated by Francesca Denley, Stéphanie Jacquemont, Christine Pagnoulle in collaboration with JudithHarris)

- Éric Toussaint – CADTM.

End of the series: From the Global North to the Global South: debt in its many states

* This text is a largely revised and extended version of the introductory lecture delivered for the workshop “Public debt in the South and North” during the National Conference of the Local Committees (CNCL) of ATTAC France held on 16 and 17 October 2010 at the University of Saint-Denis (Paris VIII) in Paris. A similar version was delivered during training sessions organized in Liège by the International Debt Observatory with CADTM on 29 and 30 November 2010 (see www.cadtm.org/Dette-publique-dans-les-pays-du,6103) as well as during the 4th workshop of CADTM South Asia held in Colombo, Sri Lanka, on 9 and 10 December (see http://www.cadtm.org/CADTM-South-Asia-meets-in-Colombo) and during a conference given in à Nagercoil in Tamil Nadu, India on 28 December 2010.

The first part is entitled: “The debt in developing countries: a dangerous unconcern”, http://www.cadtm.org/The-debt-in-developing-countries-a

[1] The term “North” in this text refers to the most industrialized countries.

[2] I had raised and denounced this fact as early as December 2008 in an article entitled “A holy union for a deuce of a swindle” http://www.cadtm.org/A-Holy-Union-for-a-Deuce-of-a There is almost no amendment to make to its content. The predictions made at the time have been entirely confirmed and the solutions put forward remain valid, though one should add the solution of debt audit resulting in repudiations/cancellations (see below in the present article).

[3] The German and French bankers alone own up to 48 % of the Spanish debt securities (the French banks holding 24% of these securities), 48% of the Portuguese debt securities (the French banks accounting for 30% of the total) and 41% of the Greek debt securities (the French banks being the largest creditors with 26%). See the figures below.

[4] Taken from C. Lapavitsas, A. Kaltenbrunner, G. Lambrinidis, D. Lindo, J. Meadway, J. Michell, J.P. Painceira, E. Pires, J. Powell, A. Stenfors, N. Teles : “The eurozone between austerity ans default”, September 2010. Source : CPIS.

[5]According to the BIS in December 2009, the French banks owned $31 billion of the Greek public debt, the German banks 23 billion dollars.

[6] This acronym is sometimes used in a derogatory, or even racist, way.

[7] Taken from C. Lapavitsas et al., op. cit., p. 30

[8]According to Alexander Sack, who theorized the doctrine of odious debt, “If a despotic power incurs a debt not for the needs or in the interest of the State, but to strengthen its despotic regime, to repress the population that fights against it, etc, this debt is odious to the population of all the State. This debt is not an obligation for the nation; it is a regime’s debt, a personal debt of the power that has incurred it, consequently it falls with the fall of this power” (Sack, 1927). For a concise overview, see (in French) “ La dette odieuse ou la nullité de la dette”, a contribution to the second seminar on International law and Debt organized by CADTM in Amsterdam in December 2002, http://www.cadtm.org/La-dette-odieuse-ou-la-nullite-de . See also “Topicality of the odious debt doctrine”, http://www.cadtm.org/Topicality-of-the-odious-debt,3515 and http://www.cadtm.org/Topicality-of-the-odious-debt

[9] Dave Zirin, “The Great Olympics Scam, Cities Should Just Say No”, www.counterpunch.org/zirin07052005.html : “But for those with shorter memories, one need only look to the 2004 Summer Games in Athens, which gutted the Greek economy. In 1997 when Athens "won" the games, city leaders and the International Olympic Committee estimated a cost of 1.3 billion. When the actual detailed planning was done, the price jumped to $5.3 billion. By the time the Games were over, Greece had spent some $14.2 billion, pushing the country's budget deficit to record levels.”

[10] See a detailed summary of the Siemens-Hellas scandal at http://www.scribd.com/doc/14433472/Siemens-Scandal-Siemens-Hellas . The charges made by the German courts against Siemens were so undeniable that in order to avoid a sentence in due form, the company agreed to pay a fine of 201 million euros to the German authorities in October 2007. The scandal has tarnished Siemens’s image to such an extent that, in an attempt to redress the situation, the transnational company conspicuously announces on its web page that it has contributed 100 million euros to an anti-corruption fund. See :

[11] Taken from C. Lapavitsas, A. Kaltenbrunner, G. Lambrinidis, D. Lindo, J. Meadway, J. Michell, J.P. Painceira, E. Pires, J. Powell, A. Stenfors, N. Teles : “The eurozone between austerity ans default”, September 2010. http://www.researchonmoneyandfinance.org/media/reports/RMF-Eurozone-Austerity-and-Default.pdf.

[12] The same occurred at the time for Portugal, Spain, and countries of Central and Eastern Europe.

[13] Taken from C. Lapavitsas et al., op. cit.

[14] 2009 figures. Among the NATO members, only the United States spends more than Greece (4.7%) in proportion to its GDP.

[15] Some of the data mentioned is taken from François Chesnais, “Répudiation des dettes publiques européennes !” in Revue Contretemps n°7, 2010, which is itself based on the data of the Stockholm International Peace Research Institute (SIPRI), www.sipri.org/yearbook

[16] At least one argument can be added for that new debt to be declared illegitimate or void, and it goes as follows: for a contract between two parties to be valid, according to Common Law, the principle of contractual autonomy, of the voluntary consent of both parties, must be fully respected, meaning that each party to the contract must be in a position to say no or refuse any clauses of the contract which go against its interests. When in March-April 2010 the financial markets started to blackmail Greece and when then the European Commission and the IMF united to impose draconian conditions on Greece (very harsh austerity measures that infringe social and economic rights), it can be considered that Greece was not really in a position to exert its autonomy and refuse them.

[19] See its website http://www.contra-xreos.gr/. This committee joined the CADTM international network in December 2010.

[20] The present section is largely drawn from a slide show by Pascal Franchet (“Actualité de la dette publique au Nord”, http://www.cadtm.org/IMG/ppt/Actualite_de_la_dette_publique_dans_les_pays.ppt).

[21] The tax rate on company profits is 39.5% in Japan, 39.2% in the UK, 34.4% in France and 28% in the US.

[22] The problems experienced by the German Hypo Reale Estate (bailed out by Angela Merkel’s government in 2007) and the collapse of the US business bank Bear Sterns (bought over by JP Morgan with the help of the Bush administration in March 2008) were partly due to dodgy hedge funds located in Dublin.

[23] See C. Lapavitsas, A. Kaltenbrunner, G. Lambrinidis, D. Lindo, J. Meadway, J. Michell, J.P. Painceira, E. Pires, J. Powell, A. Stenfors, N. Teles : « THE EUROZONE BETWEEN AUSTERITY AND DEFAULT », September 2010 – 72 pages http://www.researchonmoneyandfinance.org/media/reports/RMF-Eurozone-Austerity-and-Default.pdf

[24] Daily paper El Pais, “La deuda externa atenaza a España”, 28 February 2010, on the basis of data from the IMF and the McKinsey Global Institute.

[25] What is left of the external debt can be considered to be completely private.

[26]Herman, Barry; Ocampo, José Antonio; Spiegel, Shari, 2010, Overcoming Developing Country Debt Crises

OUP Oxford, Oxford, ISBN: 9780191573699

[27] Indeed one of the conditions set by the IMF when it helps a country about to default is that it raise local interest rates. If a country is free not to comply with IMF conditions, it can lower its interest rates so as to prevent bankruptcies.

[28] Joseph Stiglitz has defended this position on several occasions over the past ten years. See his book Globalization and Its Discontents, 2002.

[29] Journal of Development Economics 94 (2011), 95-105.

[31] In abolishing a debt, the initiative can come from the creditor (cancellation) or the debtor (repudiation).

[32] This concerned bonds falling due in 2012 and 2030 and were mainly owned by US banks.

[34] “En Grecia la asociación opaca y secreta delictiva de Goldman Sachs con el Gobierno conservador anterior estafó a la ciudadanía griega y a la europea, con el apoyo cómplice de la banca privada alemana y francesa. El rescate articulado con fondos europeos ha ido a garantizar el cobro de sus fondos a estos bancos alemanes y franceses, mientras que Goldman Sachs y anteriores responsables políticos están libres y sin cargos disfrutando de sus botines. La respuesta justa pasaba y pasa primero por imputar a estos responsables y emitir una orden de caza y captura por sus delitos para que sean juzgados; segundo por no reconocer la deuda y exigir su auditoria previa para sanearla y reconocer sólo lo justo y, tercero por anteponer los intereses sociales de los griegos a los intereses de la banca privada internacional replanteándose los presupuestos y compromisos de compra adquiridos como los nuevos submarinos a Alemania.” (…) “También allí hay motivos de sobra para juzgar los delitos de los actuales gobernantes y de los miembros de Consejo de Administración de los bancos privados. A negarse a pagar la deuda sin una auditoria previa y anteponer los intereses de la ciudadanía a los espurios de los especuladores fundamentalistas del mercado que nos mienten y engañan.”, http://www.attac.es/realidad-contra-incompetencia-de-responsables-economicos-en-la-union-europea/

[35] A Global Justice Perspective on the Irish EUIMF Loans: Lessons from the Wider World

[37] See ATTAC France’s press release about the common declaration http://www.france.attac.org/spip.php?article12053

https://www.alainet.org/en/articulo/147968?language=es

Del mismo autor

- O Banco Mundial e o FMI reconhecem distância entre o Norte e o Sul 16/02/2022

- El Banco Mundial y el FMI reconocen que se amplía la brecha entre el Norte y el Sur 07/02/2022

- A dívida e o livre comércio como instrumentos de subordinação da América Latina desde a independência 07/02/2022

- Two centuries of sovereign debt conflicts 14/01/2022

- Dos siglos de conflictos sobre las deudas soberanas 14/01/2022

- Estados Unidos: um ano de presidência de Joe Biden 10/01/2022

- Estados Unidos: Un año de presidencia de Joe Biden 04/01/2022

- Coronavirus: Global Collective Commons vs Big Pharma 25/10/2021

- Coronavirus: bienes comunes mundiales contra el Big Pharma 21/10/2021

- La apropiación de conocimientos y los beneficios del Big Pharma en tiempos del coronavirus 19/10/2021